north carolina real estate taxes

While there isnt an estate tax in North Carolina the federal estate tax may still apply. North Carolina has one of the lowest median property tax rates in the United States with only fourteen states collecting a lower median.

North Carolina State Taxes 2022 Tax Season Forbes Advisor

About North Carolinas Property Tax System Description of Tax.

. Real estate in Wake County is permanently listed and does not require an annual listing. A tax lien attaches to real estate on January 1 and remains in place until all taxes on the property are paid in full. Overview of North Carolina Taxes.

North Carolinas property tax rates are relatively low in comparison to those of other states. Imposition of Excise Tax NCGS 105-22830a An excise tax is levied on each instrument by which any interest in real property is conveyed to another person. Assessors Office 500 N.

Can a taxpayer deduct more than 10000 of real estate tax on a North Carolina return. Contact and Phone Numbers. Property Tax Consulting - All LevelsRyan is seeking Property Tax Talent ls with experience working with complex properties.

Property Tax Collections Office of the Tax Collector PO. North Carolina real and personal property tax records are managed by the County Tax Office in each county. Counties in North Carolina collect an average of 078 of a propertys assesed fair market value as property tax per year.

Property owners as of January 1 are required to report any new buildings additions improvements andor deletions. Weve known for many years that one reason North and South Carolina remain major destination states is because of the reasonable property taxes in both states amongst other factors. Cabarrus County Tax Administrator Real Estate Division Cabarrus County Governmental Center 65 Church Street SE Concord.

Land and land improvements are considered real property while mobile property is classified as personal property. For almost all the segments of the property tax January 1 is the tax lien date. Transfer taxes in North Carolina are typically paid by the seller.

The median property tax in North Carolina is 120900 per year for a home worth the median value of 15550000. As an example Brunswick Countys current rate is 485 per 100 of value. Rates vary by county and are applied to 100 of assessed value values are determined by the assessors office.

How North South Carolina Rank For Property Taxes. In North Carolina residential real estate is also taxed on an ad valorem basis with each county administering assessments and collections. Main St Ste 119.

There is an additional cost to the taxpayer for this advertising. Real Estate Appraisal Sharon Cooper cooperscopasquotankncus Land Records - Tonia Ferebee ferebeetcopasquotankncus. According to the NC Register of Deeds an excise tax is levied on each instrument by which any interest in real property is conveyed to another person This means that when you sell your home you have to pay this tax at closing to the state of North Carolina.

County Tax Rate 0077 City Tax Rate 0074 Municipal 00085. Seven counties in North Carolina are authorized to impose an. Department of Revenue does not send property tax bills or collect property taxes.

North Carolina General Statutes require local tax collectors to advertise annually all current year unpaid taxes levied on real estate in the local newspaper between March 1 and June 30. The Local Government Division provides support and services to the counties and municipalities of North Carolina as well as taxpayers concerning taxes collected locally by the counties and municipalities. WalletHubs 2022 Property Taxes By State report has been issued.

Heres how a tax credit from the NCHFA could work. Attachments or improvements can be in the form of houses outbuildings decks piersdocks bulkheads or any number of. When ownership in North Carolina real estate is transferred an excise tax of 1 per 500 is levied on the value of the property.

105-1535a2 allows a taxpayer in calculating North Carolina taxable income to deduct from adjusted gross income either the North Carolina standard deduction amount or the North Carolina itemized deduction amount. A set of North Carolina homestead exemption rules provide property tax relief to seniors and people with disabilities. The property tax in North Carolina is a locally assessed tax collected by the counties.

Your 200000 mortgage has an interest rate of 375 meaning you pay 7500 each year in interest 200000 x 375 7500. The federal estate tax exemption was 1170 million for deaths in 2021 and goes up to 1206 million for deaths in 2022. Tax Administrator Patrice Stewart stewartpcopasquotankncus Tax Listing Assessing.

Advertisement of property tax liens is required by state law. With the NC Home Advantage Tax Credit you can save up to 30 of this amount on your federal taxes 7500 x 30 2250. PO Box 25000 Raleigh NC 27640-0640.

Main St Ste 236 PO Box 97 Monroe NC 28111-0097 Collections Office 500 N. Real property is defined as land and everything attached to it along with the rights of ownership. Our property records tool can return a variety of information about your property that affect your property tax.

For example a 600 transfer tax would be imposed on the sale of a 300000 home. Union County Government Center. North Carolina Department of Revenue.

The exemption is portable for spouses meaning that with the right legal steps a couple can protect up to 2412 million upon the. The average effective property tax rate in North Carolina is 077 well under the national average of 107. Box 31457 Charlotte NC 28231-1457.

There is no mortgage tax in North Carolina. In this Practice you will work with clients in various industries telecommunications tech pharmabio-tech utilities and energy with complex properties including but not limited to specialty manufacturing facilities. If you are totally and permanently disabled or age 65 and over and you make.

The tax rate is one dollar 100 on each five hundred dollars 50000 or fractional part thereof of the. Use our free North Carolina property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics.

Is Wholesaling Real Estate Legal In North Carolina Ultimate Guide

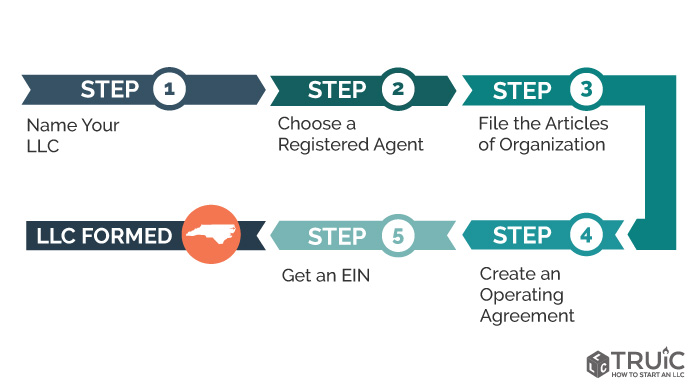

How To Set Up A Real Estate Llc In North Carolina Truic

North Carolina Real Estate Transfer Taxes An In Depth Guide

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Gift Tax All You Need To Know Smartasset

Property Tax North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

Free North Carolina Real Estate Power Of Attorney Form Word Pdf Eforms

Property Tax Relief For Homeowners Disability Rights North Carolina

Wake County Nc Property Tax Calculator Smartasset

North Carolina Buyer Closing Costs How Much Will You Pay

The Ultimate Guide To South Carolina Real Estate Taxes

The Ultimate Guide To North Carolina Property Taxes

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas