irs.gov unemployment tax refund status

Please ensure that support for session cookies is enabled in your browser. ANCHOR payments will be paid in the form of a direct deposit or check not as credits to property tax bills.

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Said it would begin processing the simpler returns first or those eligible for.

. Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion. Using the IRSs Wheres My Refund feature. The IRS will continue reviewing and adjusting tax returns in.

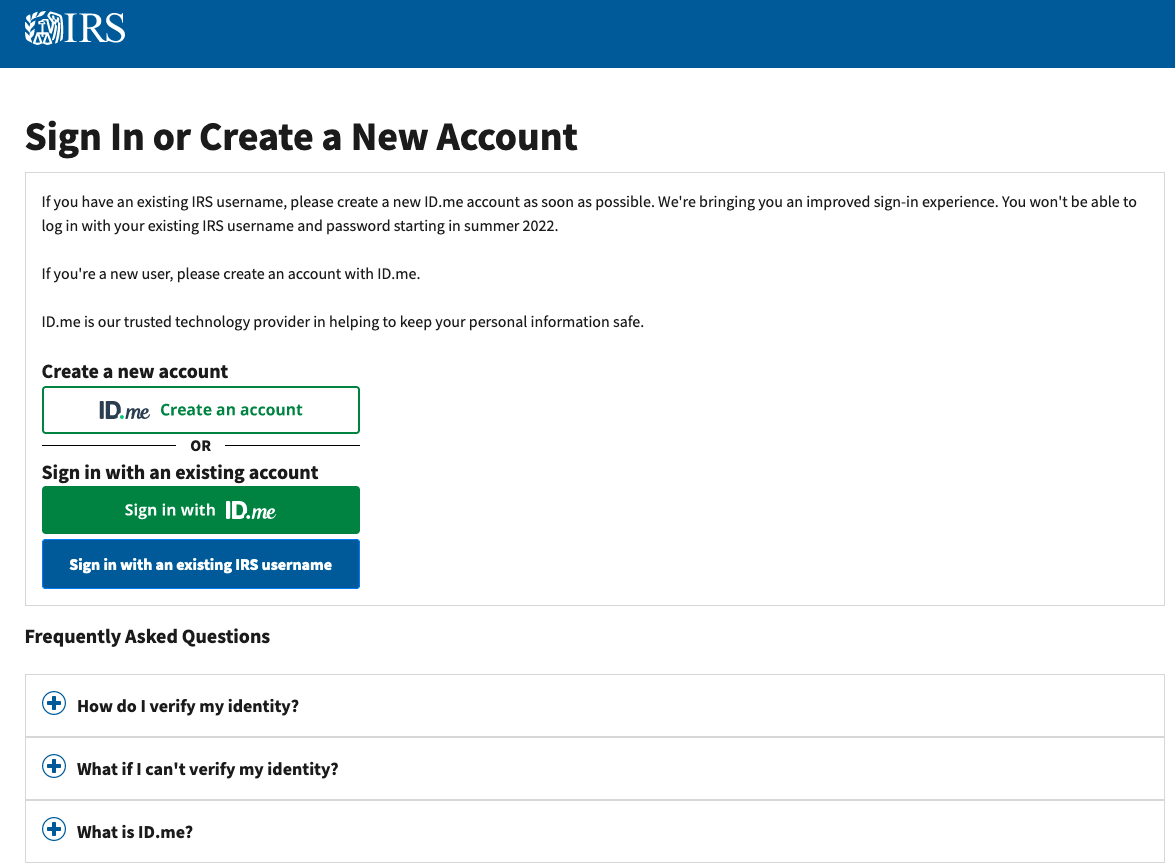

Viewing your IRS account. The tool tracks your refunds progress through 3 stages. - Opens the menu.

These are called Federal Insurance. The IRS has sent 87 million unemployment compensation refunds so far. Efile your tax return directly to the IRS.

Viewing the details of your IRS account. Prepare federal and state income taxes online. Using the IRS Wheres My Refund tool.

We are currently mailing ANCHOR benefit information mailers to. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189.

Whether you owe taxes or are awaiting a refund you may check the status of your tax return by. New Jersey State Tax Refund Status Information. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by.

Federal law requires employers to withhold taxes from an employees earnings to fund the Social Security and Medicare programs. The first refunds are expected to be issued in May and will continue into the summer. - One of IRSs most popular online features-gives you information about your federal income tax refund.

If you received unemployment benefits in 2020 a tax refund may be on its way to you. 2021 tax preparation software. Taxpayers who have access to a Touch-tone phone may dial 1-800-323-4400 within New Jersey New York Pennsylvania Delaware and.

In order to use this application your browser must be configured to accept session cookies. 100 Free Tax Filing. If you are eligible for the extra refund for federal tax that was withheld from your unemployment the IRS will be sending you an additional refund sometime during the next.

Misleading Post Links Unemployment Benefits Reduced Tax Refunds

The Irs Just Sent More Unemployment Tax Refund Checks Kiplinger

On The Irs Check My Refund Website It Says Tax Topic 152 Now After I Went Through A Very Gruesome Audit That Lasted Over A Year It Used To Say Tax Topic

/cloudfront-us-east-1.images.arcpublishing.com/gray/UEKA5DRH4VEE7DDH7MZ67VRQIY.jpg)

Irs Backlogs Causing Massive Delays In Processing Returns

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Federal Income Tax Refunds May Be Delayed By Stimulus Mistakes Paper

:max_bytes(150000):strip_icc()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

1099 Misc Form What It Is And What It S Used For

1040 2021 Internal Revenue Service

Exclusion Of Up To 10 200 Of Unemployment Compensation For Tax Year 2020 Only Internal Revenue Service

Dor Unemployment Compensation State Taxes

3 12 154 Unemployment Tax Returns Internal Revenue Service

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Admin Taxing Subjects Taxing Subjects

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Important Irs Announcements Taxpayer Advocate Report Highlights Delays In Processing Returns Ceiba